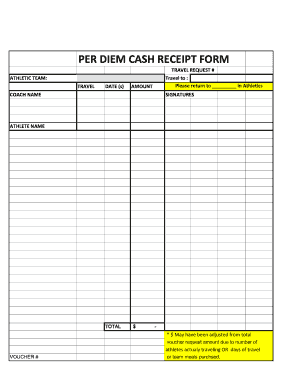

Per Diem Expense Report Form. Creating an expense report is not a tiring job when you have an effective expense report form at your disposal. Even per diem claims have recently come under scrutiny because of several high-profile fraud The truth is, whether your company deals in per diems or reimbursable expenses, any system that doesn't require documentation in the form of receipts How can I prevent per diem or expense report fraud?

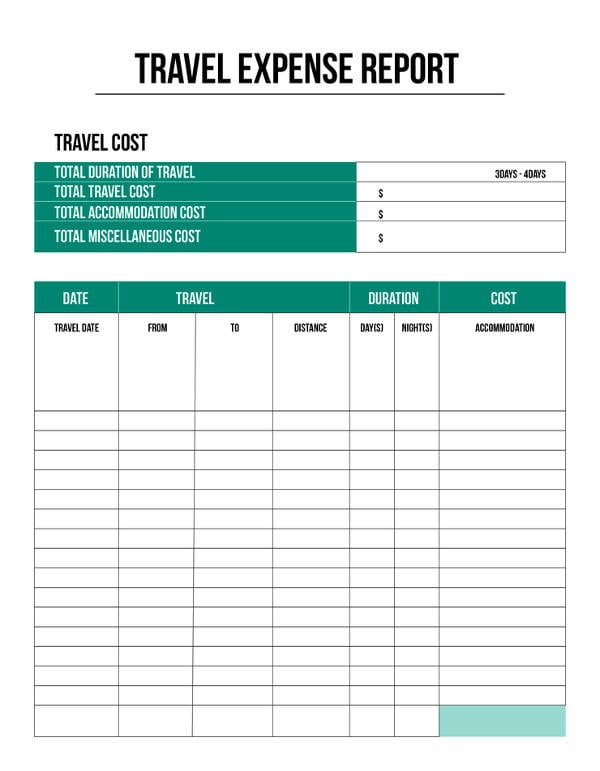

Entering an Expense Report for Travel Reimbursement.

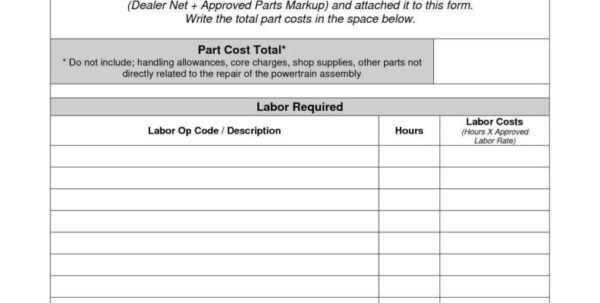

We need both to prepare your tax returns.

Please submit only one report per trip with all expenses for the the trip. Per diem is an allowance paid to your employees for lodging, meals, and incidental expenses incurred when travelling. An expense report is a form that itemizes expenses necessary to the functioning of a business.