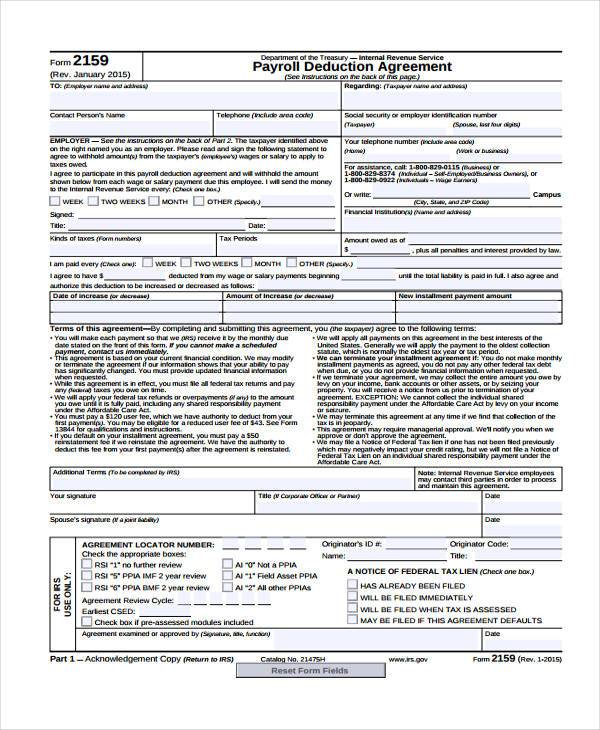

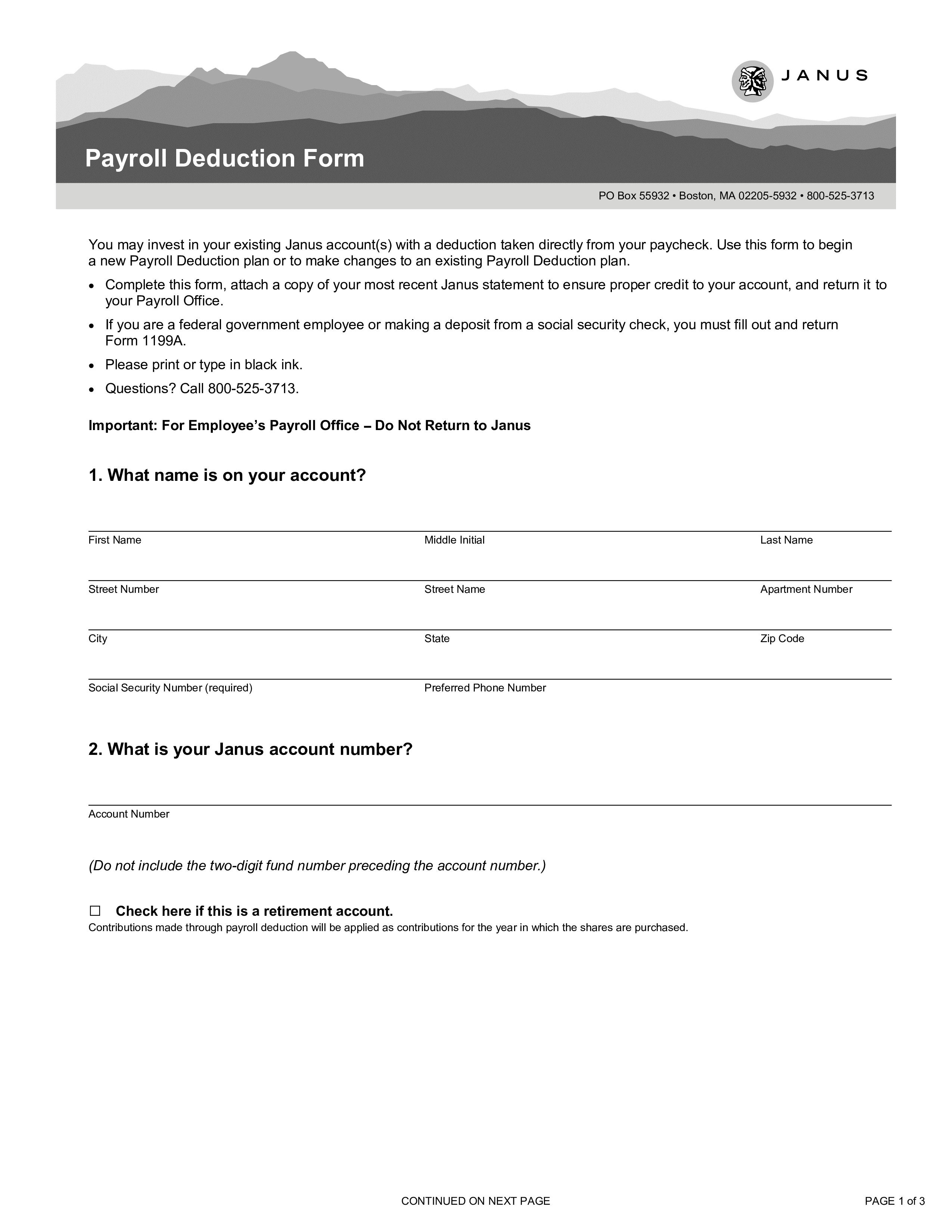

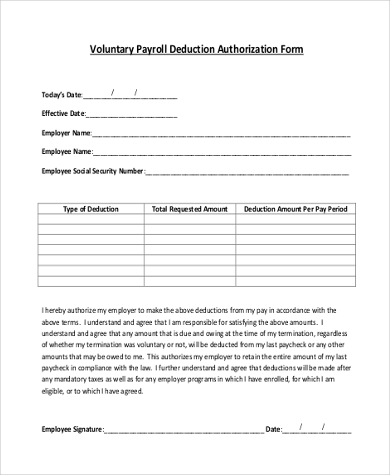

Payroll Deduction Agreement Template. Overall, a payroll deduction is the sum of money that an employer deducts from employee's paychecks. The Payroll Deduction Stock Purchase form is for employees to exercise their options for purchase of the company???s stock through a payroll deduction plan.

Legal communication is essential to individuals and companies to ensure truthful, accurate information exchange and enable morally-correct decision making.

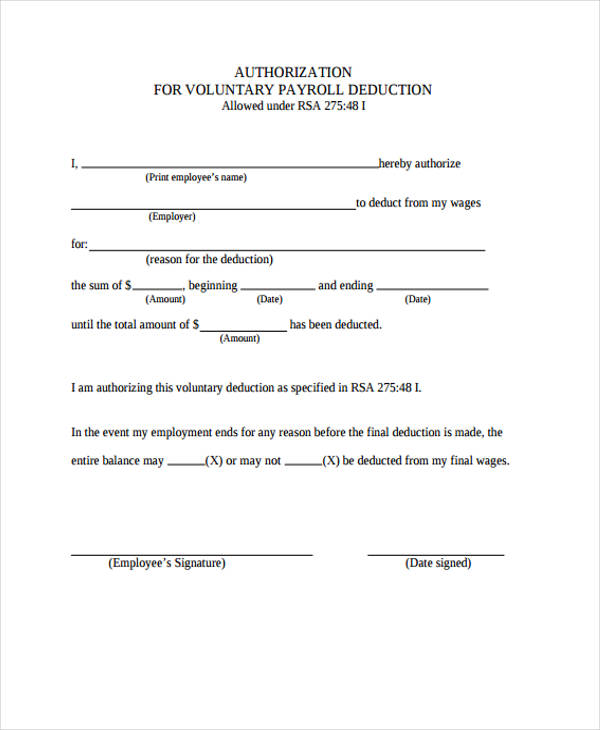

Is your organisation on the list of businesses The contract will outline what the salary for the employee is, any benefits and how often payroll This must specify the amount of the deduction and may be withdrawn in writing by the employee at any.

Now you can fill out and print a PDF blank online. Because consent in the form of an agreement to deduct payment from an employee's paycheck must come from the worker himself or herself, having their signature on this template is. The Payroll Deduction Stock Purchase form is for employees to exercise their options for purchase of the company???s stock through a payroll deduction plan.