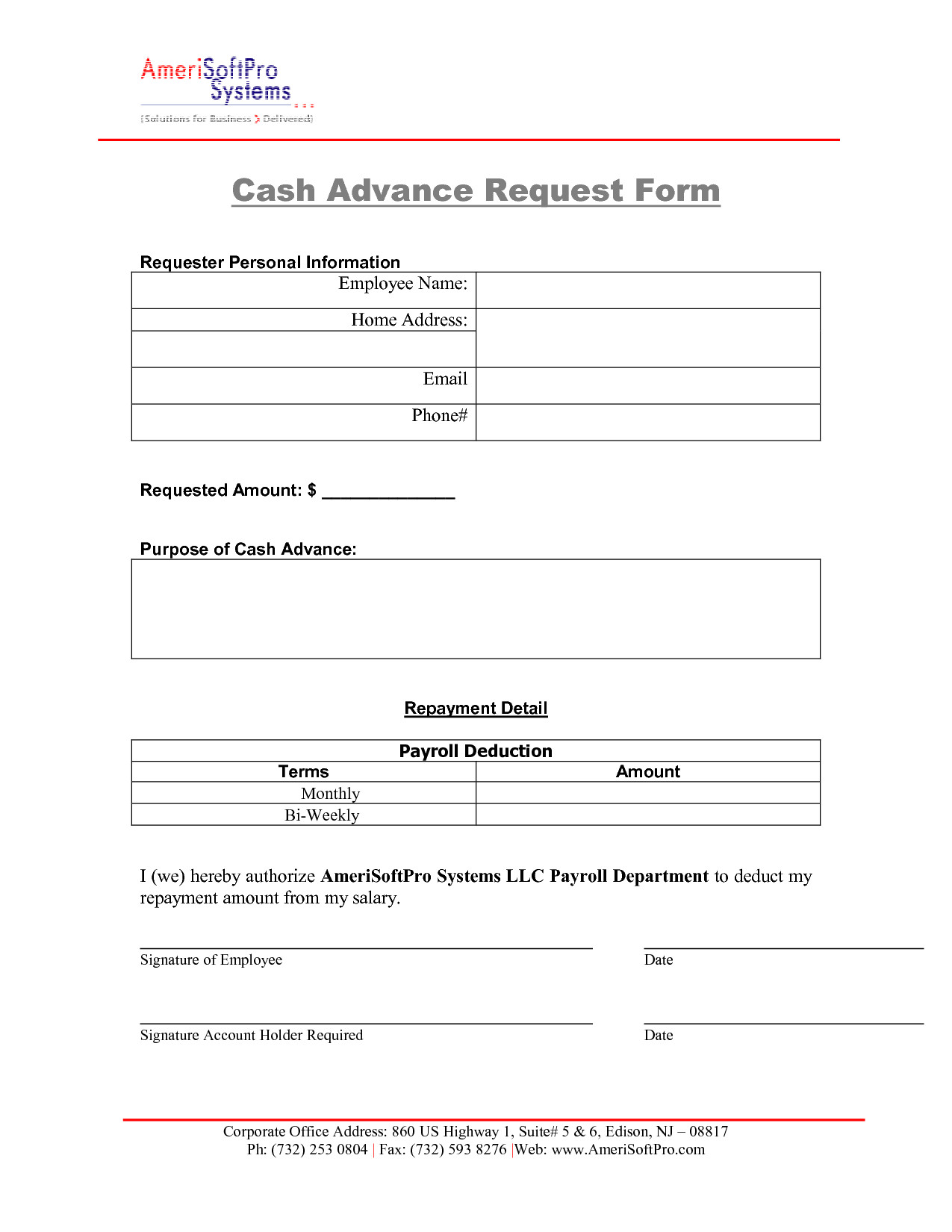

Payroll Service Agreement Form. When a new hire is welcomed to the team On this form, you document the taxes you withheld from employee wages and the taxes you paid. Hiring a payroll service or an accountant ensures you file payroll taxes correctly and avoid costly fines.

A Service Agreement, also sometimes called a General Services Agreement, is a document between a service provider and a client.

Any service agreement template will be heavily output-based, in the sense that they essentially outline what the client expects as results when the project is.

Payroll Deduction Agreement. (See Instructions on the back of this page.) Regarding: (Taxpayer name and address). • By signing and submitting this form, you authorize the IRS to contact third parties and to disclose your tax information to third parties in order to process and administer this agreement. Next, you will need to complete new enrollment forms: a Payroll Services Agreement (PSA) with Deposit Account Verification (DAV) and required POAs. Order forms and receipts plus credit authorization and agreements.